buy tax liens nj

Comply with additional requirements for special tax sales. Before buying a tax lien certificate decide where you want to invest in a tax lien then research the laws regarding liens in that specific county since they vary from area to area.

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Chatham NJ currently has 47 tax liens available as of February 1.

. Delinquency on a property may accrue interest at up to 8 per cent for the first 1500 due and 18 per cent for any amount over 1500. This includes sewer charges or any other municipal charges. Its purpose is to give official notice that liens or judgments exist.

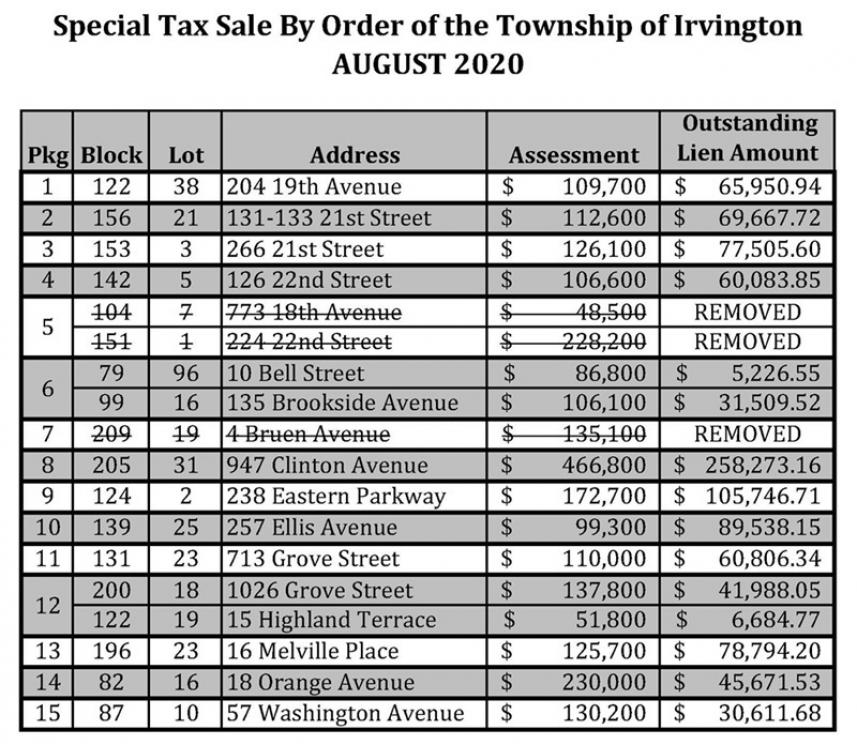

New Jersey requires municipalities to hold tax sales of delinquent property taxes at least once a year. The City of Trenton announces the tax sale of 2019 2nd quarter and prior year delinquent taxes and other municipal charges through an online auction. As an investor you can purchase a tax lien from the county for properties with unpaid taxes.

Depending on the actions of the homeowners the property may eventually become an investment property. CODs are filed to secure tax debt and to protect the interests of all taxpayers. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales.

Once youve done your research get a list of properties for sale from the county treasurer investigate potential properties and make a list of the ones you want. February 1 May 1 August 1 and November 1. There are currently 1901 tax lien-related investment opportunities in Ewing NJ including tax lien foreclosure properties that are either available for sale or worth pursuing.

Comprehensive listings of foreclosures short sales auction homes land bank deals. The tax collector is required by state law to hold a tax sale each year for the prior years unpaid municipal charges. 0-18 per annum Subsequent Redemptions.

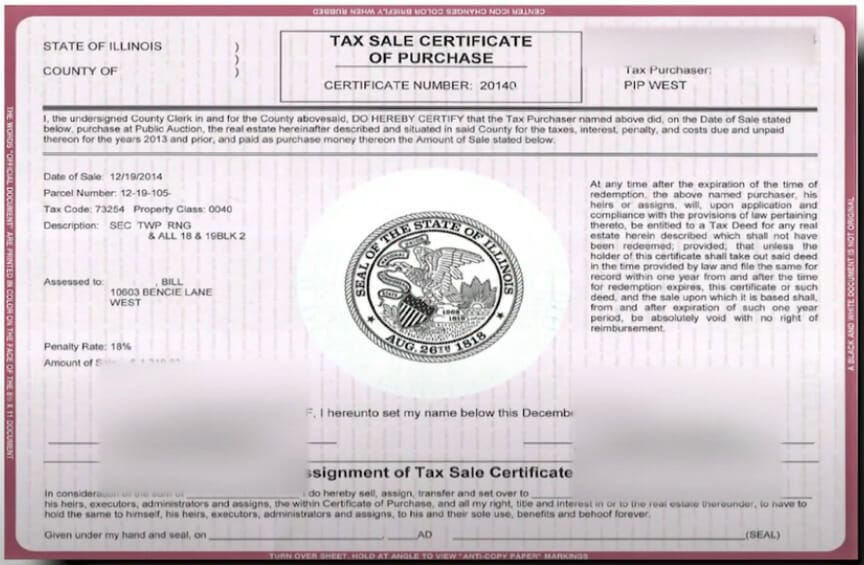

How do I buy a tax lien property in NJ. Sample NJ Tax Lien Certificate Initial Buy. For a listing of all parcels delinquencies and costs including registration and bidding instructions please visit the Tax Lien Auction site.

Can I buy tax liens in NJ. 2622 including taxes and water charges Initial Return. Find Foreclosed Properties at Huge 50 Savings.

Tax delinquent properties are advertised in a local newspaper prior to the municipal tax sale. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Chatham NJ at tax lien auctions or online distressed asset sales. Property taxes are due in four installments during the year.

You dont have to sink more money into the house or toward your tax bill. You pay the taxes owed and in exchange you get the right to charge interest on the amount owed by the property owner. A tax lien is filed against you with the Clerk of the New Jersey Superior Court.

Bidding for tax liens under the New Jersey Tax follows a procedure known as bidding down the lien. We Buy NJ Real Estate LLC is a professional homebuyer who will help you with tax liens or anything else that is keeping you from selling the property the traditional way. All at 18 per annum Some municipalities have a year end tax penalty to the homeowner between 2-6 depending on township 11.

A judgment entered in court that is available for public view. Many people look at the purchase of tax liens as an investment opportunity. Ad Search For Cheap Houses Starting from 10000.

The sale of tax lien certificates is a solution to a complex problem Ocean County New Jersey recovers lost revenue needed to fund local services the property owner gets more time to satisfy their delinquent property tax bill and the purchaser receives a tax lien certificate which is real estate secured and offers up to 18 per annum mandated by New Jersey law. Ad Find Tax Lien Property Under Market Value in New Jersey. There are buyers and investors out there who are ready to help you right now.

Since the amount that the bidder must pay for the lien is fixed by law bidders compete on the basis of the interest rate the property owner is charged if and when the owner redeems the property. In New Jersey property taxes are a continuous lien on the real estate. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the.

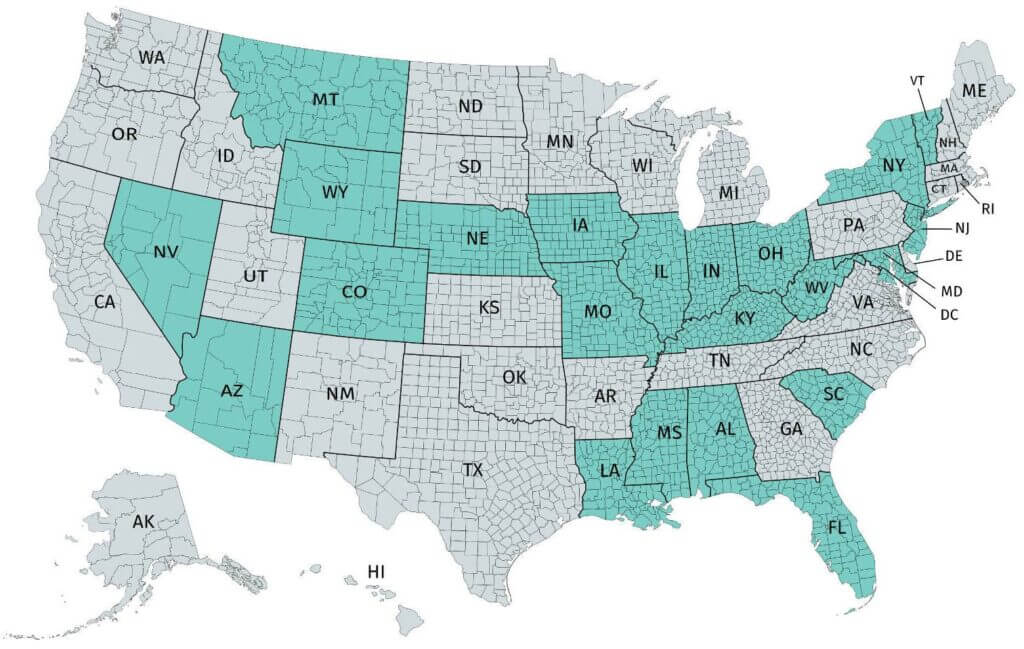

In New Jersey tax lien certificates are sold at each of the 566 municipal Tax Sales. Since the amount that the bidder must pay for the lien is fixed by law bidders compete on the basis of the interest rate the property owner is charged if and when the owner redeems the property. Check municipality registration requirements.

Read Title 54 of the New Jers. Anyone wishing to bid must register preceeding the tax sale. If you do not pay your property taxes a lien will be sold against the property for any unpaid taxes owed from the previous year.

This gives you the right to take the propertys deed if the owner does not pay off the entire delinquent tax amount plus any fees. There are currently 349 tax lien-related investment opportunities in Brigantine NJ including tax lien foreclosure properties that are either available for sale or worth pursuing. 1 To See All The Listings.

BIDDING DOWN TAX LIENS Bidding for tax liens under the New Jersey Tax follows a procedure known as bidding down the lien. Tax lien investing is the act of buying the delinquent tax lien on a property and earning profits as the property owner pays interest on the certificate or from the liquidation of the collateral securing the loan. Ad Compare New Jersey foreclosed homes by neighborhood schools size more.

But in many cases youll simply enjoy the higher interest payments of the tax lien while the homeowner repays their debt.

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube

Which States Are The Best For Buying Tax Liens Alternative Investment Coach

Hundreds Of Properties For Tax Sale In Monroe County Monroe County County Stroudsburg

Tax Lien Lady Testimonial Investing Coach Testimonials

Invest In Tax Liens Tax Deeds In Canada Instead Of The Stock Market Investing How To Get Money Safe Investments

Tax Liens An Overview Checkbook Ira Llc

Make Money With Tax Liens Know The Rules Ted Thomas

Bid4assets Com Online Real Estate Auctions County Tax Sale Auctions Government Auctions Real Estate Dream Big Online Auctions

Tax Lien Lady Testimonial Investing Coach Testimonials

Credit Repair Expo 2018 Credit Repair Using Section 609 Credit Repair Attorney Nj How To St Credit Repair Business Credit Repair Services Credit Repair

How To Remove A Lien On Your Home New Home Buyer Us Real Estate Lets Do It

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Tax Lien Investing Pros And Cons Youtube

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Real Estate Tax Lien Investing

Tax Liens The Complete Guide To Investing In New Jersey Tax Liens Paperback Overstock Com Shopping The Best Deals On G Investing Books Bestselling Books

Profiting On Hud Properties Tax Lien Investing Investing Real Estate Investing Free Webinar