are salt taxes deductible in 2020

Using Schedule A is commonly referred to as itemizing deductions. Organizing an LLC for your business can convert non-deductible SALT into a business expense.

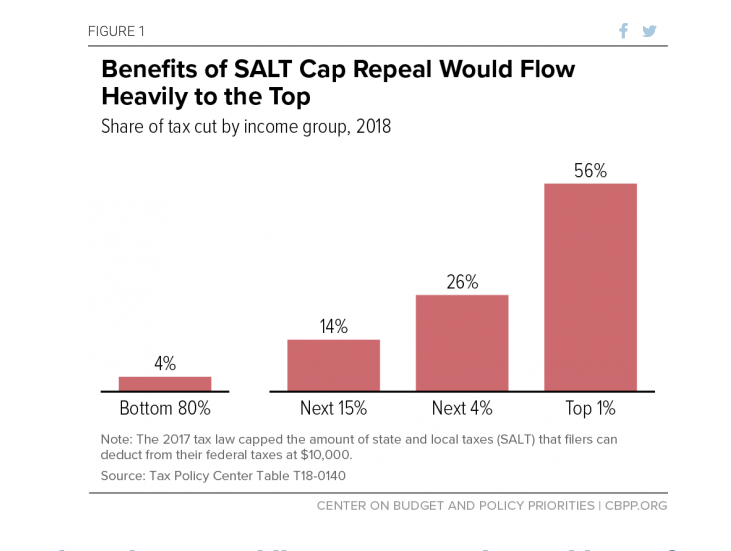

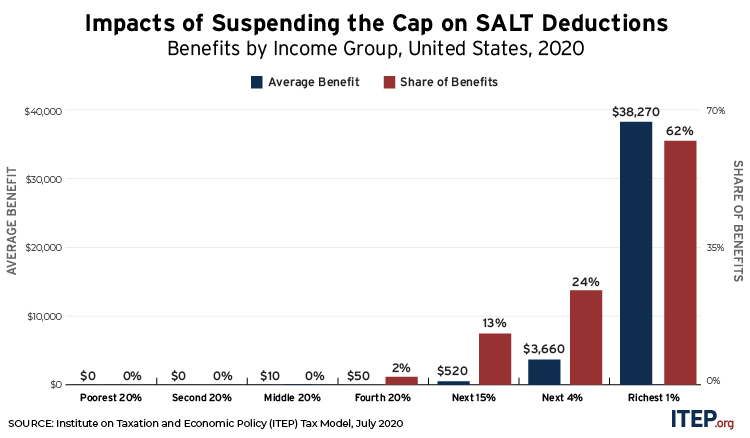

Eliminating The Salt Cap To Help The Rich Doesn T Fight Coronavirus Ways And Means Republicans

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms.

. A change in the tax laws effective for 2018 limits SALT and all other schedule A taxes deduction to 10000 so you have an excess of 10045 that is not showing on the. The Tax Cuts and Jobs. For your 2021 taxes which youll file in 2022 you can only itemize when.

The Tax Cuts and Jobs Act of 2017 TCJA included an unfavorable cap on the ability to deduct state and local taxes SALT as an. In Notice 2020-75 the IRS acknowledges these uncertainties. IR-2019-59 March 29 2019 The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the.

Now that the validity of these taxes has been confirmed by the IRS it is possible that more states may enact some form of. Those in lower tax brackets would benefit from lower savings through the SALT deduction while those in the highest tax bracket could save up to 3700 in federal income. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a.

If you pay state and local taxes during 2021 in the amount of 15000 then you are allowed to take a federal tax deduction of 10000 on your IRS tax return if you itemize. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. But you must itemize in order to deduct state and local taxes on your federal income tax return.

The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in computing their nonseparately. 52 rows The SALT deduction is only available if you itemize your deductions using Schedule A. The state and local tax deduction is claimed on lines 5-7 on Schedule A when you file your Form 1040.

The SALT deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes they paid that year up to 10000. COVID-19 the American Rescue Plan Act of 2021. Dec 15 2020.

The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to taxpayers who itemize. If you dont itemize. Deductions for state and local sales tax SALT income and property taxes can be itemized on Schedule A.

Seventeen states have enacted SALT cap workaround laws and several. Second the 2017 law capped the SALT deduction at 10000 5000 if.

Judge Dismisses States Challenge To Salt Deduction Limit Don T Mess With Taxes

What Is The Salt Tax Deduction Forbes Advisor

Tax Deductions Lower Taxes And Tax Liability Higher Refund

Salt Cap Repeal Salt Deduction And Who Benefits From It

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

2020 Key Tax Numbers For Individuals Eclectic Associates Inc

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

Trump Tax Plan Accounting Today

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

State And Local Tax Deduction Salt The Impact By State

Salt Cap Repeal Has No Place In Covid 19 Legislation National And State By State Data Itep

2021 Year End Priority Pass Through Entities Should Pay State Taxes By 12 31 The Dancing Accountant

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

Salt Deduction Limits And Pass Through Entities Dallas Business Income Tax Services

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Opinion Why Are Democrats Pushing A Tax Cut For The Wealthy The New York Times